How to Trade on CFD in Binomo

What is a CFD trading mechanics?

CFD stands for Contract For Difference. It’s a mechanics where a trader gets additional profit on the difference between the buy and the sell prices of assets.The goal is to make a forecast of whether the price of an asset will rise or fall. If the forecast is correct, a trader will get additional profit that is determined by the difference between the opening price and the closing price.

Note. A CFD mechanics is only available on the demo account.

How to trade on CFD?

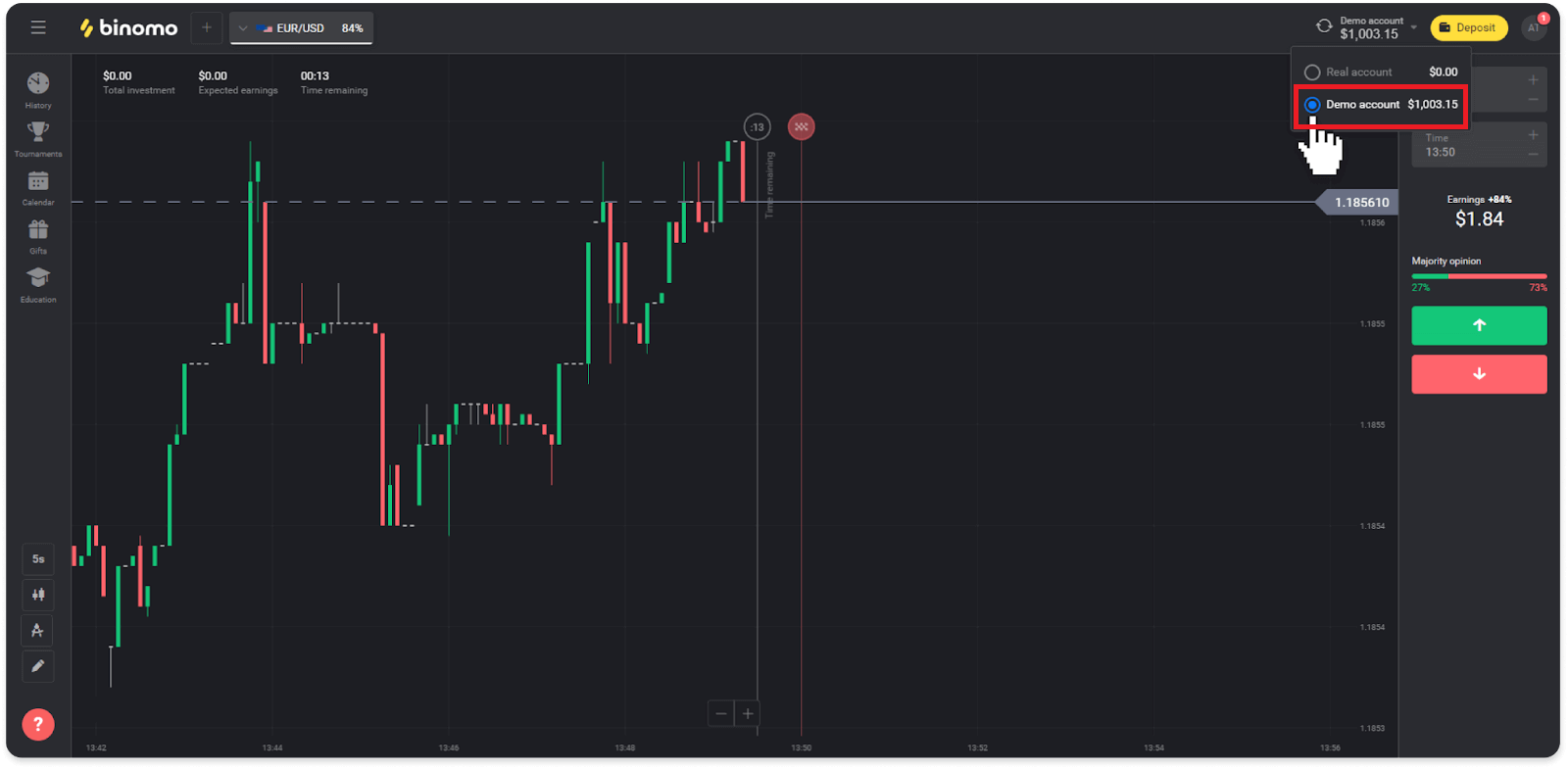

To trade on CFD, follow these steps:1. Switch to the demo account.

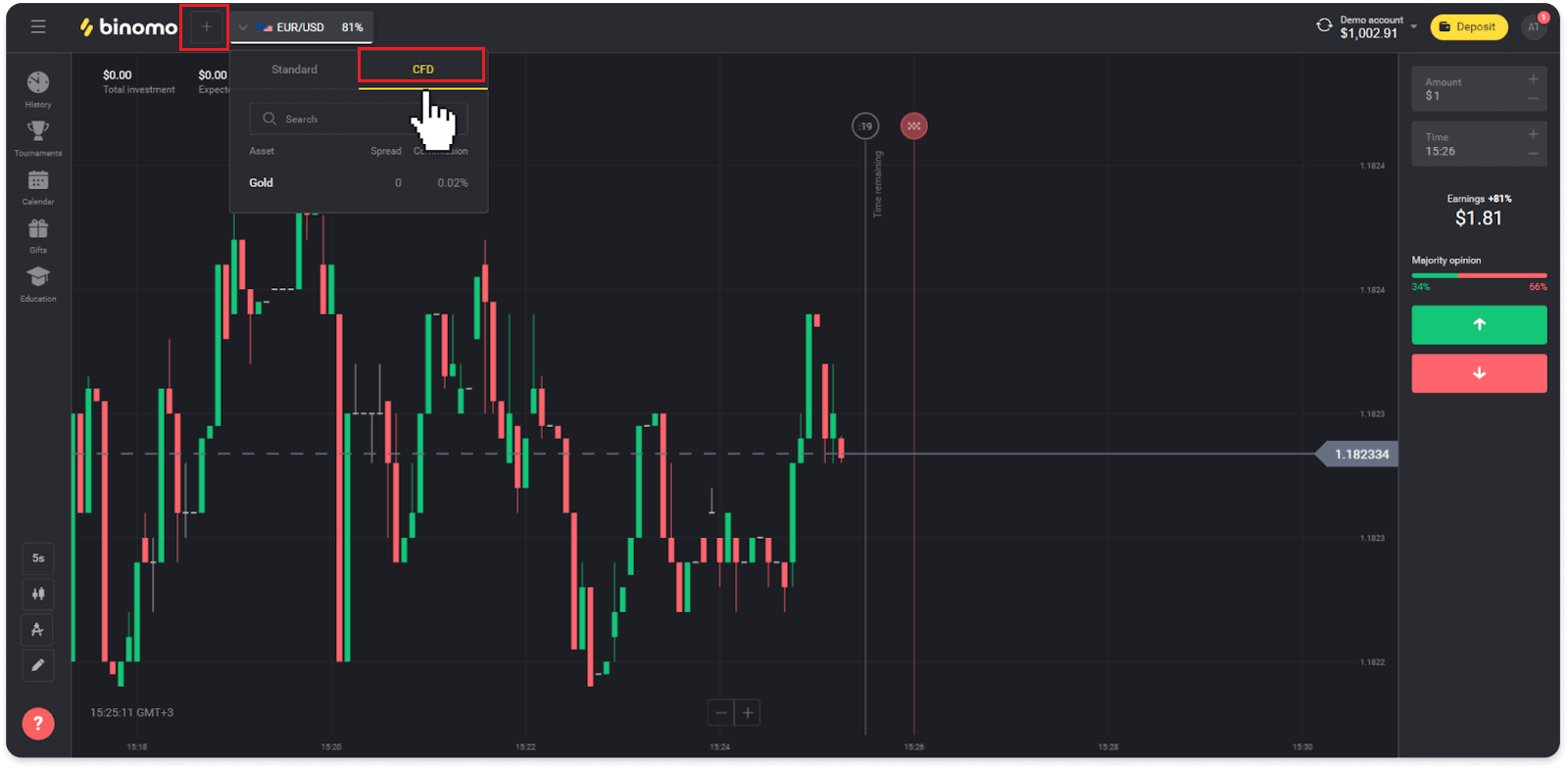

2. Open the list of assets and click on the “CFD” section.

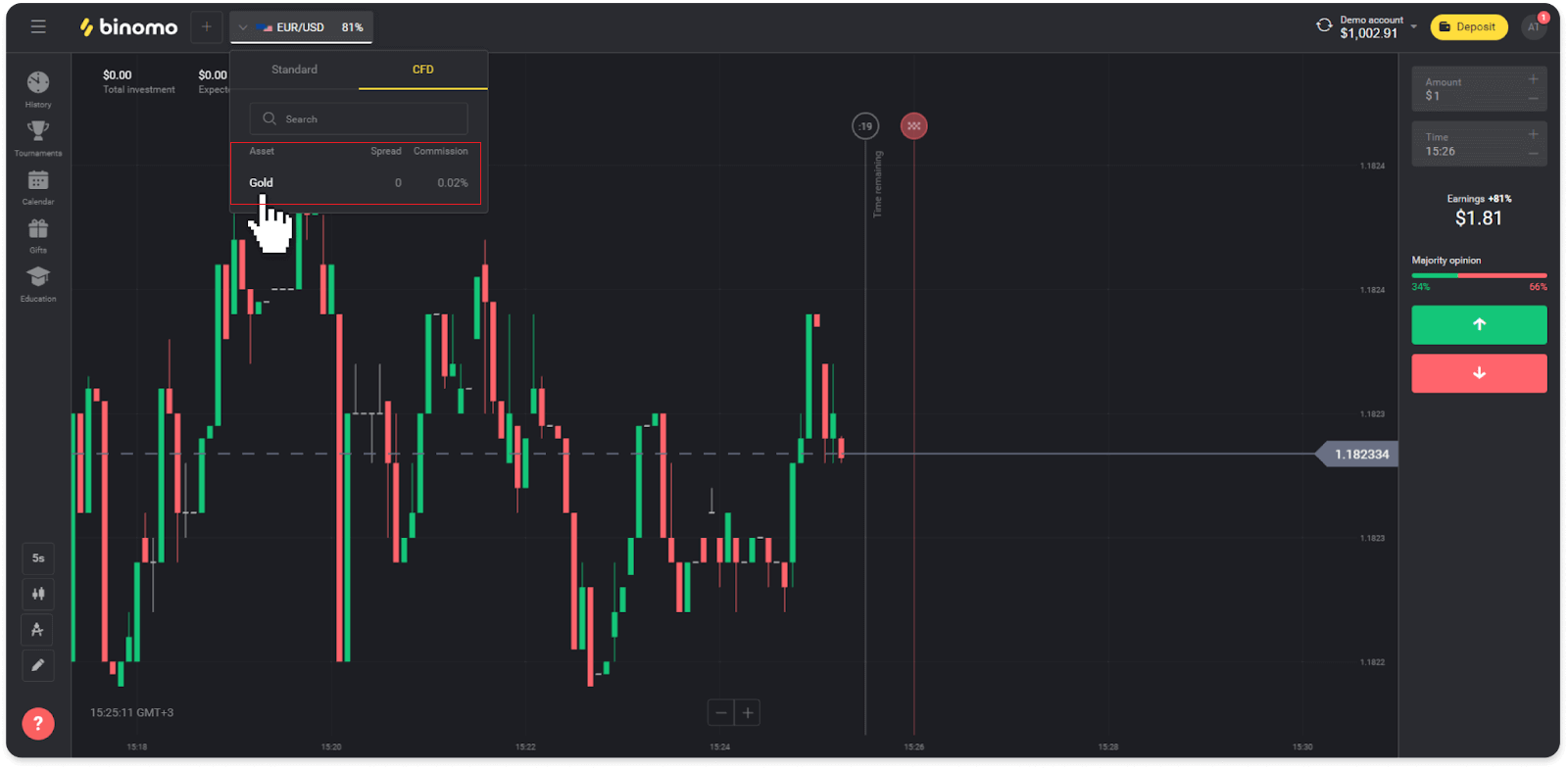

3. Select an asset you would like to trade on.

4. Fill in the trade amount – the minimum amount is $1, the maximum – $1000.

5. Set the multiplier – multiplier options are 1, 2, 3, 4, 5, 10.

6. Select the “Up” or “Down” arrow depending on your forecast.

7. Open a trade by clicking “Trade”.

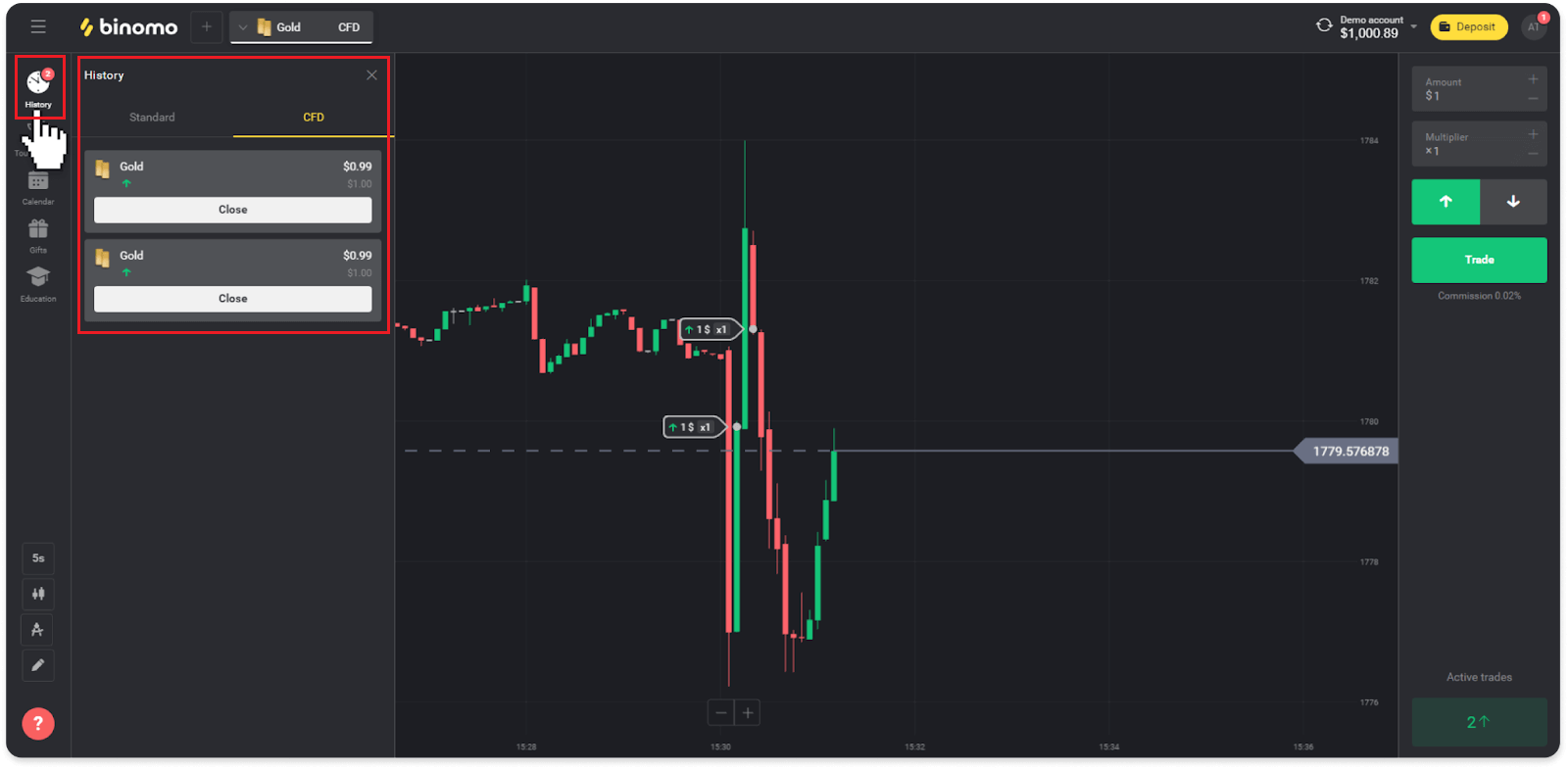

8. Follow the trade in the “History” section, “CFD” tab (“Trades” section for mobile app users).

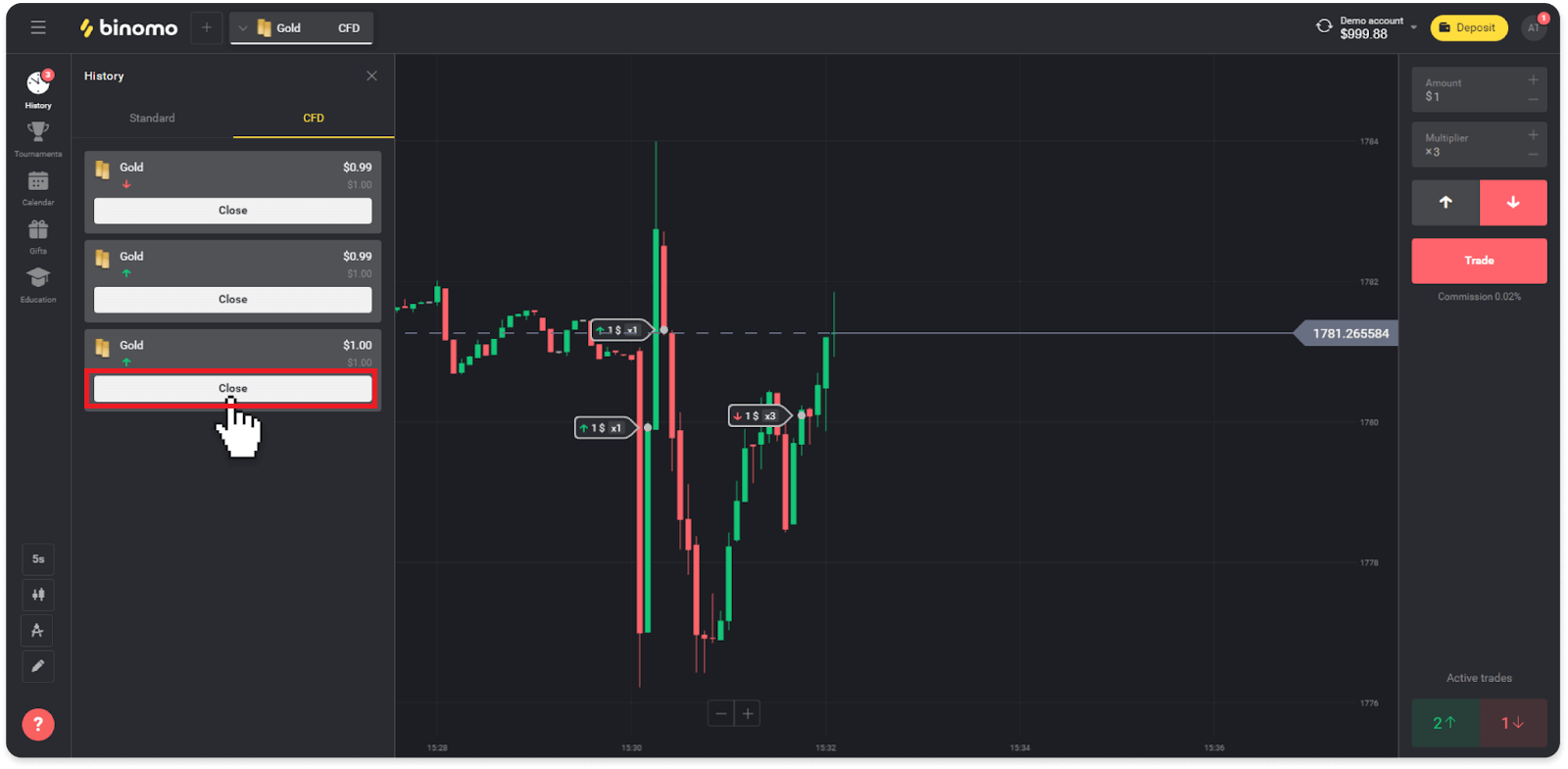

9. Close the trade manually at the desired time by clicking the “Close” button.

Note. The trade will be automatically closed after 15 days from the time of opening.

How to calculate profit and loss of a CFD trade?

You can calculate possible profit or loss with this formula:Investment x multiplier x (closing price / opening price - 1).

Example. A trader invested $100 with a multiplier of 10. When a trader opened a trade, the price of the asset was 1.2000, when they closed it – it rose to 1.5000. How to calculate a profit from that trade? $100 (trader’s investment) x 10 (multiplier) x (1.5000 (closing price) / 1.2000 (opening price) - 1) = $100 x 10 x (1,25 - 1) = $250 is a profit of the trade. The trade was successful because the closing price was higher than the opening price.

Maximum loss per trade reaches up to 95%. Here’s how you can calculate it:

Example. A trader invested $500. The result of the trade is calculated according to the formula 5% x $500 = $25. This way, the maximum loss that the trader may have before the trade is closed automatically is 95%, or $475.

The maximum percentage of change in the price of the asset (before the automatic closing) is calculated by this formula:

Maximum loss / multiplier

Example. 95% / multiplier of 10 = 9,5% is the maximum percentage of change in the price of the asset.

Frequently Asked Questions (FAQ)

Why are trades closed after 15 days on CFD?

We decided that since the trading on CFD is only available on the demo account – 15 days is the optimal time to study the mechanics and strategies.If you want to keep a trade open for a longer time, you can consider automatic closing to fix the profit. Once the trade is closed, you can open a new one with the same volume.

Why can I only trade on a demo account on CFD?

CFD is new mechanics on the platform that’s currently being improved by our developers. We enabled the possibility to trade on CFD on the demo account to allow traders to get familiar with the mechanics and test their CFD strategies using virtual funds.Follow our news, and we’ll notify you when this mechanics becomes available on the real account.

What is a multiplier?

The multiplier is a coefficient by which your initial investment is multiplied. This way, you can trade with a much higher amount than the one you are investing and get additional greater profit.Example. If your initial investment is $100 and you use a multiplier of 10, then you will trade with $1000 and receive additional profit from the investment of $1000, not $100.

Multipliers 1, 2, 3, 5, and 10 are available on the platform.

Why is the commission charged on CFD, and how is it calculated?

Trading on CFD implies a commission that is debited from your demo account. We added this commission to imitate trading on the real account. It allows traders to practice the principles of funds management, which is extremely important in trading with this mechanic.How is this commission calculated?

When you open a CFD trade, a fixed commission of 0.02% of the trade volume is debited from your demo account.

This formula calculates the trade volume:

the investment amount x selected multiplier. Available multipliers are 1, 2, 3, 4, 5, and 10.

The commission is calculated according to the following formula:

the trade’s volume x 0.02%.

Example. The volume of a trade of $110 and with an x3 multiplier will be $110 x 3 = $330.

In this case commission will be $330 x 0.02% = $0.066 (rounded to $0.07)